no archiving can evade these regulations

The most significant laws governing document archiving including the General Data Protection Regulation (GDPR) impose various requirements that companies must adhere to when archiving documents. Some of these requirements include:

archiving formats

It is essential for companies to store their documents in suitable archiving formats that guarantee readability and long-term availability.

data protection

Strict adherence to data protection requirements is crucial when storing personal data of employees, business partners, and customers. It involves secure storage, necessary deletion when appropriate, and protection against unauthorized access.

audit proofing

To ensure audit-proof archiving, companies must guarantee that documents, records, and receipts subject to retention cannot be altered after archiving. This requirement encompasses key elements such as inalterability, traceability, completeness, and availability.

retention requirements

Compliance necessitates retaining tax documents, including invoices, receipts, and tax returns, as well as business documents such as commercial letters, accounting records, and financial statements. The specific retention period typically ranges from six to ten years, depending on the document type and industry.

why digital is better for archiving

Meeting these stringent archiving requirements with peace of mind necessitates the adoption of a digital archiving solution.

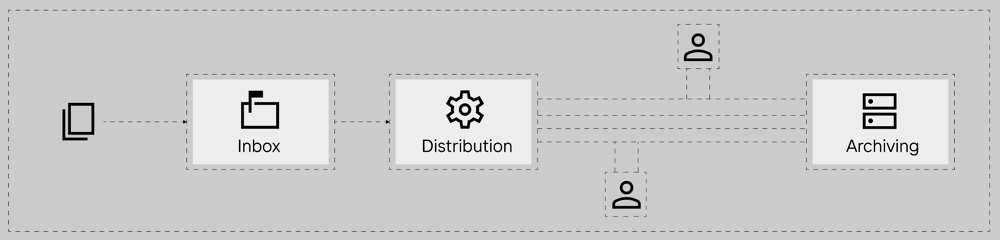

Digital archiving enables the establishment of a structured and standardised process for managing all relevant documents. This process is characterized by systematic and controlled procedures that should be meticulously documented in procedural guidelines. These guidelines provide clear instructions on the storage locations of data and documents within specific IT systems, as well as the designated access rights for individuals within the organisation.

simplifying digital archiving: seamless audit-proof archiving from the start

Digital archiving systems such as easy archive are already designed to meet the requirements of GDPR. These systems provide all the necessary formats and employ a finely granular role and rights concept, enabling transparent implementation of even complex access regulations for archived documents.

Investing in archiving software means embracing an IT system that incorporates audit-proof archiving from the outset. These solutions are purpose-built to address the specific needs of modern archives, including the demands of the digital workspace and legally compliant workflows mentioned earlier. Additionally, archiving software, such as easy archive, simplifies the digitalisation of paper-based documents, eliminating any media disruptions.